October 17th (AMSP/CGTN) – – Africa is experiencing a boom in digital payments, driven by a surge in fintech innovations and mobile technology adoption. The rise of mobile money has reshaped business and daily lives alike, where smartphones are the new wallets, CGTN’s Daniel Arapmoi reports.

Sub-Saharan Africa has shown significant growth in financial inclusion over the past decade—much of it driven by mobile money account adoption.

Across Africa, digital payments are booming—with 17 percent of consumers using them daily and nearly half at least weekly in 2023.

According to the World Bank, the number of digital payment users in Sub-Saharan Africa increased by 191 million between 2014 and 2021.

Africa’s digital payments market is expected to grow by 152 percent by 2025.

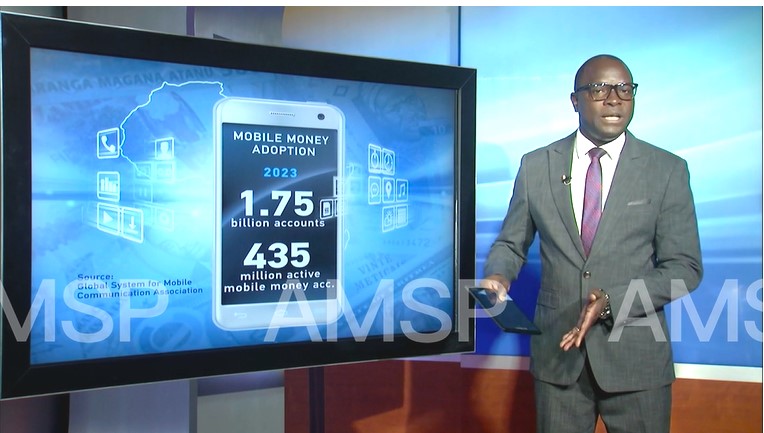

Data released by the Global System for Mobile Communication Association, shows mobile money adoption and active use continues to grow but at a slower rate than in previous years. Registered accounts grew to 1.75 billion in 2023, a 12% year-on-year increase.

By the end of 2023, there were approximately 435 million active mobile money accounts — a 9 percent annual rise.

Agent networks continued to grow, driven by increased agents in Sub-Saharan Africa.

Compared to 2022, registered agents grew by 22% in 2023 to reach 18.6 million, while active agents grew by 14% to 8.3 million.

At least 307 billion dollars was digitized by agents during the same year.

Over the past few years, West Africa has emerged as mobile money’s new powerhouse. In 2023, over a third of new registered and active 30-day accounts globally were from West Africa. This was more than any other region with Nigeria, Ghana and Senegal being the main drivers of growth.

International remittances and merchant payments were among the fastest-growing mobile money use cases in 2023.

Transaction values for international remittances grew to approximately 29 billion dollars— a one-third increase compared to 2022. Much of this growth was driven by West Africa.

Merchant payments grew by 14%, reaching around 74 billion dollars in 2023.

Between 2013 and 2022, the total gross domestic product in countries with a mobile money service was $600 billion higher than it would have been without mobile money.

Beyond contributing to financial and digital inclusion, increasing mobile money use has led to higher GDP – particularly among countries in East and West Africa.

amsp/cgtn-abp

CGTN